In today's dynamic business landscape, flexible equipment finance empowers companies to acquire cutting-edge tools without straining budgets. By thoroughly reviewing operational needs and goals, businesses can customize financing options like leasing or loans, aligning with their strategic objectives. This approach boosts efficiency, enables access to advanced technology, and ensures a competitive edge while maintaining healthy cash flow. Through careful planning, research, and KPI tracking, companies measure the return on investment (ROI) of new equipment, confirming its positive impact on operations and profitability.

Improve business operations with new equipment. In today’s competitive landscape, understanding your business needs and goals is paramount for success. This article guides you through essential steps, starting with identifying specific requirements and exploring flexible equipment finance options tailored to your budget. We delve into a strategic implementation process, highlighting best practices for measuring success and maximizing return on investment (ROI) through new acquisitions. By the end, you’ll be equipped with insights to revolutionize your business operations.

- Understanding Your Business Needs and Goals

- Exploring Flexible Equipment Finance Options

- Implementing New Equipment: A Strategic Approach

- Measuring Success and ROI (Return on Investment)

Understanding Your Business Needs and Goals

Before investing in new equipment, it’s crucial to take a deep dive into your business needs and goals. Flexible equipment finance options allow businesses to acquire the necessary tools without breaking the bank. By understanding your specific operational requirements, you can tailor your financing to fit like a glove. This ensures that the new equipment truly supports and enhances your workflow, boosting efficiency and productivity in the long run.

Whether it’s state-of-the-art machinery, cutting-edge software, or advanced robotics, each business has unique demands. Flexible finance plans cater to these diverse needs, enabling you to spread out payments over time. This approach provides immediate access to much-needed assets while keeping cash flow in check. By aligning your equipment choices with strategic business objectives, you’re not just making an acquisition—you’re investing in a brighter future for your operations.

Exploring Flexible Equipment Finance Options

In today’s competitive business landscape, staying agile and adaptable is key to success. One effective strategy to enhance operational efficiency is by exploring flexible equipment finance options. These arrangements offer businesses the opportunity to acquire the latest machinery and technology without committing substantial capital upfront. Instead, they can lease or finance these assets over a set period, aligning with their financial goals and cash flow management. This approach provides several advantages, including improved cash flow, access to cutting-edge equipment, and the ability to upgrade regularly as technology evolves.

Flexible equipment finance allows companies to tailor their financing terms, choosing between leasing, purchasing through a loan, or even a hybrid model. Such flexibility ensures businesses can select the option that best suits their needs, whether it’s a short-term solution for an upcoming project or long-term acquisition to support sustained growth. By leveraging these financial tools, organizations can drive operational improvements, increase productivity, and remain competitive in their respective industries.

Implementing New Equipment: A Strategic Approach

Implementing new equipment is a strategic move that can significantly enhance business operations, but it requires careful planning and consideration. The first step is to assess your current operations, identifying areas where new technology or machinery could streamline processes, increase efficiency, and reduce costs. This involves understanding your specific needs and the unique challenges your business faces. Once these gaps are pinpointed, research different equipment options that align with your goals. Flexible equipment finance solutions offer businesses the opportunity to acquire the necessary assets without a large upfront investment, allowing for more capital retention and enabling companies to access cutting-edge technology.

When evaluating potential purchases, consider factors such as initial cost, long-term value, maintenance requirements, and how each piece of equipment will integrate into your existing infrastructure. A strategic approach ensures that any new additions are not only an upgrade but also a sound financial decision. By carefully matching equipment to business needs and exploring flexible financing options like lease-to-own models or rental with purchase agreements, companies can maximize their investment and stay competitive in the market.

Measuring Success and ROI (Return on Investment)

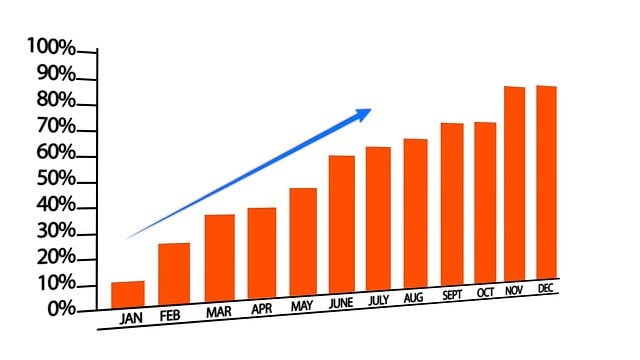

Measuring success and ROI is a crucial step in determining the effectiveness of new equipment acquisition through flexible equipment finance options. By setting clear metrics, businesses can objectively assess whether the investment has brought about the desired improvements in operations. Key performance indicators (KPIs) should be established before implementing any changes; these could include increased productivity, reduced downtime, improved product quality, or lower maintenance costs.

Regularly tracking and analyzing these KPIs allows for a comprehensive understanding of the equipment’s impact on business outcomes. This data can then be used to calculate ROI, which compares the benefits gained from the investment against the cost of the new equipment. A positive ROI indicates that the flexible finance arrangement has been successful in enhancing operational efficiency and profitability.